The demand for skilled bookkeepers is undeniable. As businesses grow, the complexity of maintaining accurate financial records quickly surpasses the capacity of most owners, making your expertise not just a convenience, but a necessity. For those with a passion for numbers and organization, launching a home-based bookkeeping business offers a lean, scalable, and rewarding career path with low initial financial risk.

This guide provides a complete roadmap, moving beyond simple checklists to offer a thorough explanation of how to build a successful and authoritative bookkeeping practice from the ground up. We will explore the strategic decisions, legal frameworks, and operational setups that transform a bookkeeping skill set into a thriving business.

Part 1: The Strategic Foundation—More Than Just Crunching Numbers

Before buying software or designing a logo, the most critical step is to define your business strategy. This foundational work will guide every subsequent decision, from your marketing language to your pricing structure.

Define Your Niche: The Power of Specialization

While it may seem counterintuitive to limit your potential client base from the start, specializing in a specific niche is one of the most powerful strategies for a new bookkeeping business. Focusing on one or two industries—such as e-commerce, construction, digital marketing agencies, or nonprofit organizations—allows you to develop deep expertise.

This specialization provides several key advantages:

- Expertise and Efficiency: You become fluent in the specific financial challenges, terminology, and software common to your niche. This allows you to onboard clients faster, work more efficiently, and deliver greater value.

- Higher Margins: Specialized knowledge is a premium service. Clients are often willing to pay more for a bookkeeper who understands the nuances of their industry, from SaaS revenue recognition to real estate trust accounts.

- Targeted Marketing: Knowing your ideal client makes marketing significantly easier. You can create content, join online communities, and network in places where your target audience gathers, making your outreach efforts far more effective.

Design and Price Your Services for Value, Not Hours

Once you have a niche, you can design service packages that solve their most pressing problems. Avoid the trap of hourly billing, which punishes efficiency and makes it difficult for clients to budget. Instead, adopt a value-based pricing model with tiered monthly packages.

A typical three-tiered structure might look like this:

- Tier 1 (Essentials): This foundational package covers core bookkeeping tasks like bank and credit card reconciliations, transaction categorization, and the generation of monthly financial statements (Profit & Loss, Balance Sheet).

- Tier 2 (Growth): This mid-level package includes everything in the essentials tier, plus services like accounts payable (A/P) and accounts receivable (A/R) management, and bill pay coordination.

- Tier 3 (Advisory): The premium package is for clients who need more strategic insight. It can include everything from the lower tiers, plus cash-flow forecasting, key performance indicator (KPI) dashboards, and regular advisory calls.

In addition to monthly retainers, always offer a separate, one-time “cleanup” or “catch-up” project. Priced separately, this service brings a new client’s messy books up to date before rolling them into a recurring monthly package. This protects your time and ensures you start every new engagement with a clean slate.

Part 2: Building Your Legal and Financial Framework

With your strategy in place, the next step is to establish the formal structure of your business. This ensures you operate legally, protect your personal assets, and maintain financial integrity from day one.

Choose Your Business Structure: LLC vs. Sole Proprietor

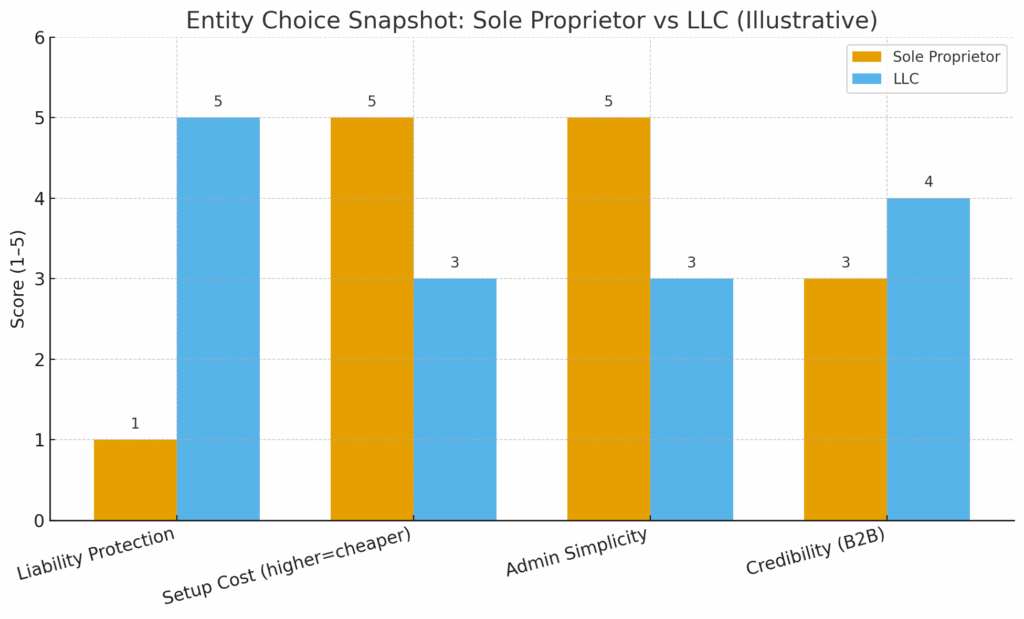

The two most common structures for a solo bookkeeper are the sole proprietorship and the Limited Liability Company (LLC).

- Sole Proprietorship: This is the simplest and least expensive structure to form. You and the business are considered a single entity, meaning there is no legal separation between your personal and business assets. While easy to start, this structure leaves your personal assets vulnerable if the business incurs debt or is sued.

- Limited Liability Company (LLC): An LLC creates a separate legal entity, shielding your personal assets (like your home and savings) from business debts and lawsuits. This “corporate veil” provides crucial protection. While it involves state filing fees and some additional paperwork, an LLC also presents a more professional image to clients and financial institutions.

For most bookkeepers, forming an LLC is the recommended path. The liability protection it offers is a significant advantage when handling sensitive financial data for other businesses.

Secure the Necessary Licenses, Permits, and Insurance

Compliance is non-negotiable. While requirements vary by location, here is what you will likely need:

- Employer Identification Number (EIN): Even if you don’t have employees, obtaining a free EIN from the IRS is essential for opening a business bank account and establishing your business’s identity.

- Local Business Licenses: Check with your city, county, and state to see what general business operating licenses are required.

- Doing Business As (DBA): If you operate under a trade name that is different from your personal name or the legal LLC name, you will need to register a DBA.

- Professional Liability Insurance: Also known as Errors & Omissions (E&O) insurance, this is critical. It protects you from claims of negligence or mistakes in your work.

- General Liability & Cyber Insurance: General liability covers third-party risks like a client slipping in your home office, while cyber insurance is increasingly vital to cover costs associated with a data breach.

Establish Your Financial Operations

To maintain professionalism and simplify your own accounting, immediately open a business checking account and get a business credit card. This separation of finances is fundamental to clean bookkeeping. Set up your own books in the accounting software you plan to use for clients and establish a system for setting aside money for quarterly estimated tax payments.

Part 3: Assembling Your Modern Toolkit

A remote bookkeeping business thrives on efficiency and security. A lean, effective technology stack and a professional home office setup are essential for delivering high-quality service and earning client trust.

The Lean Tech Stack

Start with the essentials and add tools as your business grows. Your initial stack should include:

- General Ledger (GL) Software: Choose either QuickBooks Online or Xero. Master one platform first before attempting to offer services on both.

- Receipt Capture: Tools like Dext or Hubdoc automate data entry by pulling information from receipts and bills, saving you hours of manual work.

- Proposals and Engagement Letters: Use a service like PandaDoc or Ignition for professional proposals and legally binding e-signatures. A clear engagement letter is crucial for defining the scope of work, fees, and responsibilities of both parties.

- Secure File Storage: Use a reputable cloud service like Google Drive or Dropbox with a clear, logical folder structure for each client.

- Password Manager: A password manager like 1Password or Bitwarden is non-negotiable for securely managing login credentials for your clients’ sensitive accounts.

The Professional and Secure Home Office

Your physical workspace should inspire confidence and protect client data.

- Dedicated & Secure Space: A dedicated office with a door and a locking file cabinet is ideal.

- Ergonomics and Efficiency: Dual monitors are a must-have for efficient bank reconciliation and report analysis.

- Professional Communication: A high-quality webcam and microphone, along with a neutral background, are essential for professional client video calls.

- Data Security: Implement full-disk encryption on your computer, enable multi-factor authentication on all applications, use a shredder for physical documents, and maintain both cloud and physical backups of your data.

Part 4: Go-to-Market Strategy—Attracting Your First Clients

With your business structured and your tools in place, it’s time to find clients. A simple, direct approach is often the most effective.

Build Your Online Presence

You don’t need a complex website to get started. A professional one-page site is sufficient. It should clearly state who you serve (your niche), the outcomes you deliver, your service packages, and an easy way for potential clients to book a discovery call.

Simultaneously, create and optimize a Google Business Profile. This is a free tool that improves your visibility in local search results, adding a layer of credibility to your new business.

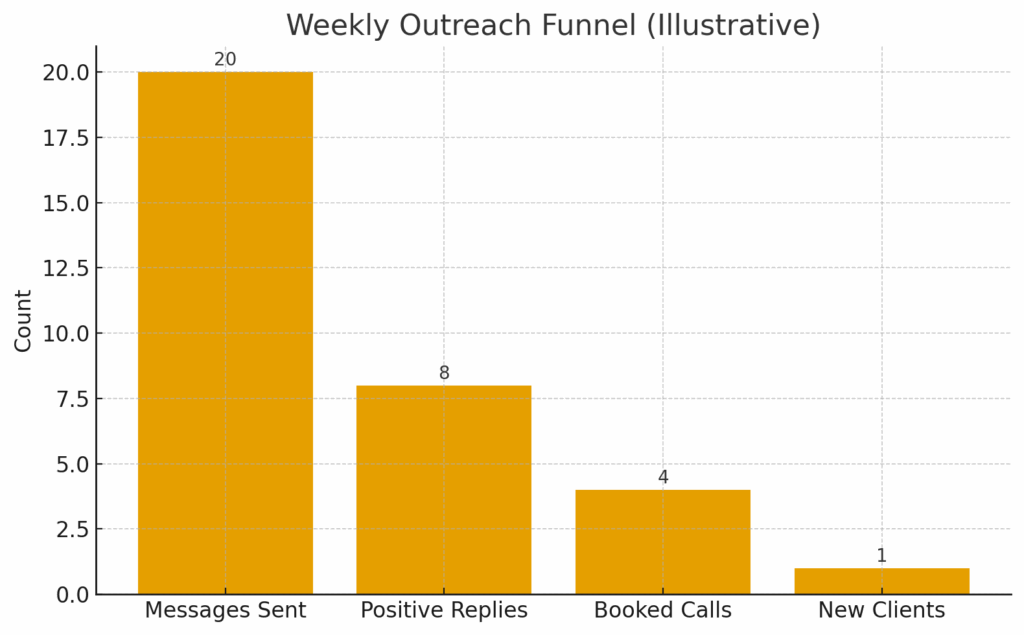

Implement a Consistent Outreach Plan

Waiting for clients to find you is not a strategy. Proactive, warm outreach is key to building initial momentum.

- Leverage Your Network: Start by reaching out to former colleagues, friends, and family. Let them know about your new business and who you are looking to serve.

- Build Professional Partnerships: Connect with CPAs, fractional CFOs, and business coaches whose clients may need your services. These relationships can become a powerful source of referrals.

- Engage in Your Niche: Participate in online communities where your ideal clients spend their time, such as industry-specific Facebook groups or LinkedIn forums. Offer helpful advice and establish yourself as a knowledgeable resource.

Aim to send 10–20 personalized outreach messages each week. The goal of this outreach is not to sell, but to start conversations and book introductory calls. By consistently executing this strategy, you can secure your first few clients and begin building a sustainable, recurring-revenue business.

FAQs

Do I need a certification to start a bookkeeping business?

While not legally required, certifications from platforms like QuickBooks Online or Xero can enhance your credibility and technical skills.

Can I serve clients in different states or countries?

Yes, a key benefit of a remote business is the ability to work with clients anywhere. However, be clear about your limitations regarding state-specific payroll and sales tax laws.

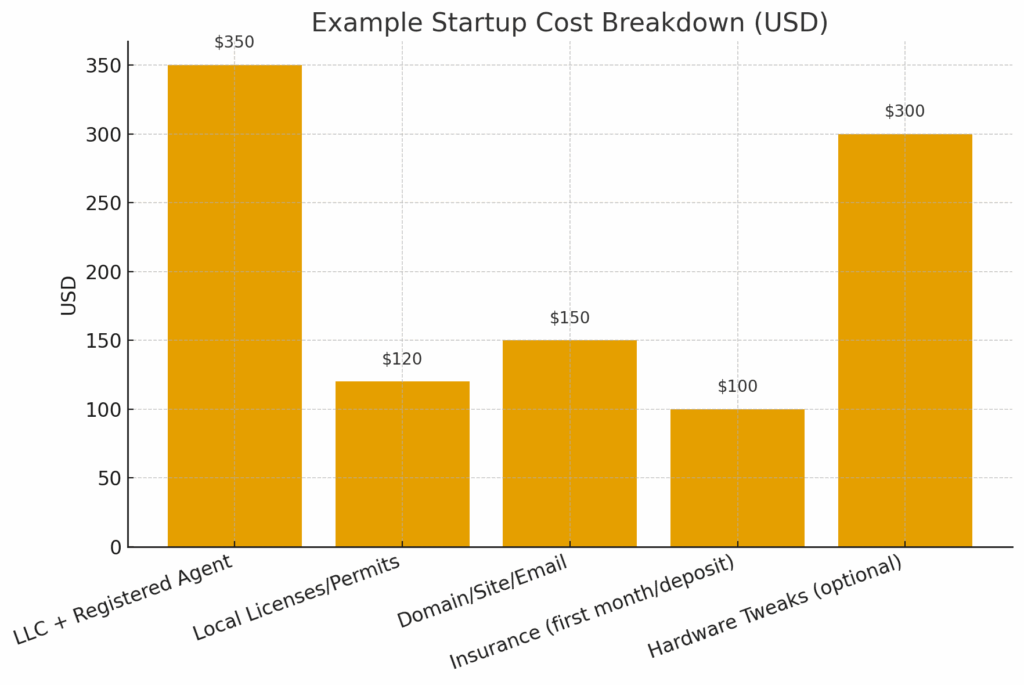

How much does it cost to start?

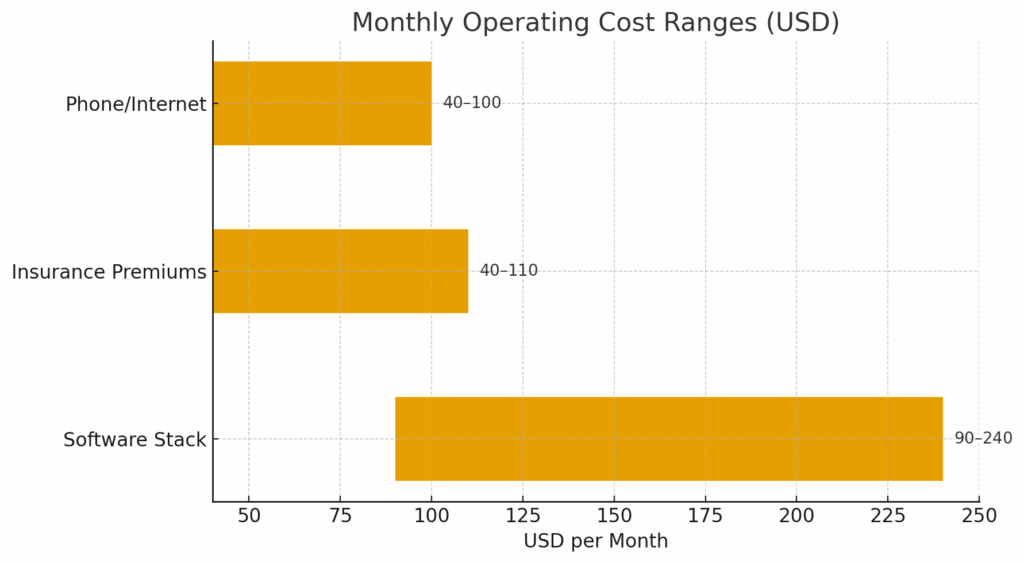

A lean home-based bookkeeping business can be started for as little as a few hundred dollars up to around $2,000, depending on one-time costs like LLC formation and equipment. Ongoing monthly costs for software and insurance typically range from $170 to $450.